6th Annual General Meeting Report Held On 20th April 2018

1.0 PREAMBLE

The Parliamentary Pension Scheme was established by an Act of Parliament to provide retirement benefits to Members of Parliament and staff of the Parliamentary Commission on permanent and pensionable terms. Section 18 of the Act establishes the Board of Trustees with the responsibility of management and control of the Scheme. The Board is required to submit reports to the Annual General Meeting under Section 25 of the Act.

The 6th Annual General Meeting was held on 20th April 2018.

The opening session started with a word of prayer led by Hon. Alice Alaso Asianut.

2.0 OPENING REMARKS BY THE CHIEF OPERATIONS MANAGER

Nightingale Mirembe Ssenoga (Ms.), Chief Operations Manager, Parliamentary Pension Scheme

The Chief Operations Manager welcomed Members to the 6th Annual General Meeting.

The highlights of her presentation included the following;

a) During the financial year 2016/17, the Return on Investment was 15.7% before tax and 11.2% after tax. With regards to the outlook, there was low return on Government instruments, relatively higher return on loans and a recovery of the NSE equity market.

b) The service providers included Kenya Commercial Bank as the Custodian, while the Fund Managers included Gen Africa Asset Managers and Stanlib.

c) The Scheme received subvention of Ugx.27 Billion from the sponsor which was 56% of the Scheme’s budget. The proportion of operational expenses of Assets was 1.9%, which was within the 2% globally acceptable proportion of administrative costs on the Fund.

d) The Scheme at the time had twelve (12) staff holding positions as listed below;

1. Chief Operations Manager

2. Head of Internal Audit

3. Finance Manager

4. Benefits Administration Manager

5. Administrative Secretary

6. Administration Officer

7. Information Technology Officer

8. Accountant

9. Loans Officer

10. Administration Assistant

11. Assistant Accountant

12. Office Assistant/Driver

e) The Scheme had developed and in some instances reviewed existing policy documents to guide its operations. These included;

o The Pensions regulations

o Board Annual Calendar

o Scheme Budget( Operational, Procurement and Training plans)

o Benefits Administration Manual

o Administration and Operations Manual

o Investment Policy Statement and

o Lending regulations and loans Policy

f) The key achievements included the following;

o Achieved optimum funding level,

o Developed and reviewed Governance policies,

o Operationalized the loans scheme,

o Timely payment of pension and other benefits, and

o Accredited and licensed Board of Trustees.

g) The challenges registered included the following;

o Incomplete information on member files,

o Unclaimed benefits,

o Inadequate storage and office space,

o Loan product perceived as discriminatory to pensioners,

o Lack of medical scheme for pensioners,

o Low pensions for members who joined before 2011;

o Poor attendance during Member education programs.

h) Work in progress included the strategic plan, investment policy statement, Members Handbook and proposed Amendment to the PPS Act.

i) The status of recommendations of the Auditor General for FY 2016/17 were as follows;

|

|

Issue |

Status |

|

1. |

Fund Managers reports and contracts to bear the legal name of the Scheme |

An addendum to the contracts to correct the legal name of the Scheme was made. The Fund Managers corrected the anomaly and use the legal name “Parliamentary Pension Scheme” on all reports and correspondences.

|

|

2. |

Harmonize the method of computing income using the inclusive/exclusive method |

Adoption of the inclusive/exclusive method was communicated to the Fund Managers who agreed to implement with effect from April 2018 after installation of their new system.

|

|

3. |

Expedite the process of reviewing the key policy documents |

The Engagement contract for the Investment Policy Statement was ready for signing, The Human Resource Manual was approved by the Board, The Scheme regulations were submitted for gazzettement and the development of the three year Strategic Plan 2017- 2020 commences April 2018.

|

|

4. |

The Custodian provides the withholding tax agents with proper Scheme details including the TIN. |

Currently all certificates were issued in the name of “Parliamentary Pension Scheme” with its TIN.

|

j) She urged Members to visit the Scheme and update their records as well as attend member education sessions for knowledge in financial literacy which was vital in retirement planning.

3.0 CHAIRPERSONS STATEMENT

The Chairperson welcomed Members and Service Providers present to the 6th Annual General meeting. He informed Members that the event was being held in accordance with section 25(a) and (c), of the Parliamentary Pensions Act 2007.

The following were highlights of the Chairpersons Statement;

i) The Board was able to implement the Scheme’s Strategic Plan and invested members’ funds profitably.

Hon. Achia Remigio, Chairperson- Board of Trustees delivering his opening remarks

ii) The investment income before tax increased from Ug. Shs. 12.54 billion to Ug. Shs. 19.85 billion representing a growth of 58.4% compared to 18.7% in 2016.

iii) The Assets of the Scheme grew from Ug. Shs. 104.14 billion to Ug. Shs. 152.83 billion. The members’ growth was attributed to minimal payout of benefits that increased investable funds during the year.

iv) The benefits paid out amounted to Ug. Shs. 2.05 billion compared to Ug. Shs. 38.49 billion paid out last year.

v) The fund posted a reasonable return on average investable fund of 15.7% before tax and 13.8% after tax.

vi) The Scheme operationalized the Loans Scheme and reviewed Scheme’s Strategic documents such as the Governance Manual.

vii) During the financial year 2016/17, the economy grew by 3.9%. The low growth was partially attributed to the adverse weather conditions that led to low agricultural production.

viii) The annual headline inflation was at 6.4% while core inflation was 4.9% by June 2017.

ix) Equity Market in Kenya recovered after conclusion of elections. The Nairobi Securities Exchange ALL Share Index (ALSI) improved to 0.09% in June 2017, compared to -14.48% in June 2016. The Local Share Index (LSI) improved to -0.91% in June 2017 compared to -25.79 in June 2016. The 91-day Treasury bills posted on average yield of 8.4%. The overall inflation was 6.3%.

x) The stocks at Uganda Securities Exchange also gained some grounds where the ALL Share Index (ALSI) improved from -14.47% in 2016 to -4.3% in 2017. The LSI reduced the loss to 1.7% in 2017 from 19.4% in 2016. The 91-day Treasury bills registered an average interest rate of 10.6% during the year. On average inflation was 5.5%. During the financial year 2016/17, the shilling depreciated by 5.28% to the US Dollar.

xi) In Tanzania, the ALSI dropped from -8.98% to -10.67% in 2017 while the LSI improved to -0.38% in 2017. The overall inflation was 5.2%.

xii) In Rwanda, the ALSI was -4.04% in 2017 while the LSI was -10.67% in 2017. The overall inflation was 5.7%.

xiii) The global economic growth was gaining momentum because of a broad based recovery in which trade, manufacturing and investment were all rebounding economies.

xiv) The Sub-Saharan Africa’s growth was projected at 2.6% in 2016 but was expected to pick up to 3.6% in 2018.

xv) Kenya projected growth at 6.2%, Tanzania at 7.1% and Rwanda at 6.8%. The positive outlook would result in better returns in securities asset investment.

xvi) The Ugandan economy was expected to rebound to the projected 5.0% in 2018.

xvii) The Scheme was to invest in an improved pension administration platform to support efficient and effective service delivery to members.

xviii) The Scheme registered the following achievements during the year;

• Operationalization of the Loans Scheme.

• Established and reviewed policies and procedures such as the Human Resources and Benefits Administration Manuals.

• Enhanced the capacity of the Board of Trustees and staff through training.

• Established a monitoring and evaluation system for the performance of investments.

• Strengthened Risk Management through continuous appraisal of the effectiveness of the internal control systems.

• Member sensitization and training.

• Recruitment of key staff.

xix) The Scheme also experienced challenges during the year namely;

• Delays in the procurement process.

• Members slow response and failure to provide information to update their files.

xx) The Chairperson expressed his gratitude to the Parliamentary Commission and Government for continued funding. He thanked the Board of Trustees, Management and Staff of the Scheme and Service Providers for their dedicated services and support.

4.0 SPEECH BY THE CHIEF GUEST – RT. HON. SPEAKER

The Chief Guest – the Rt. Hon. Speaker was represented by Hon. Aridru Gabriel Ajedra Gadison, Minister of State General Duties, Ministry of Finance, Planning and Economic Development.

i) He delivered apologies of the Rt. Hon. Speaker who was not able to attend due to other engagements.

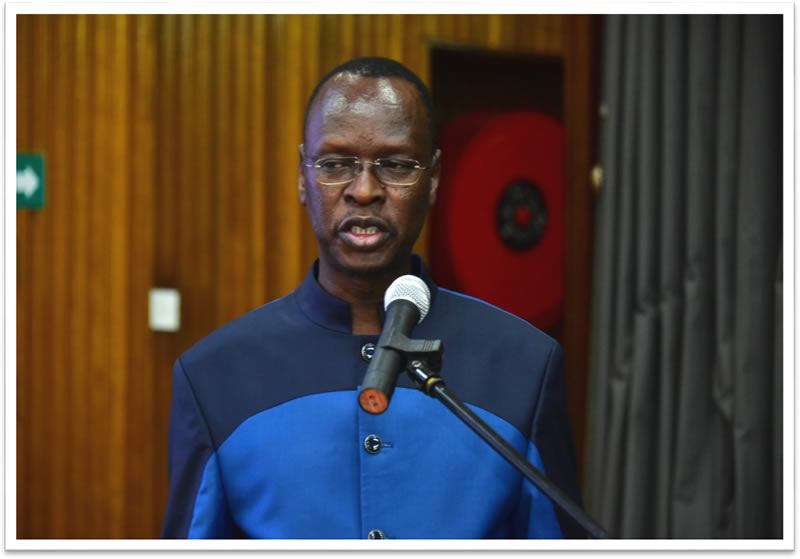

Hon. Aridru Gabriel Ajedra Gadison Minister of State General Duties Ministry of Finance, Planning and Economic Development

In her speech she stressed that;

ii) Annual General Meeting was one way the Board provides accountability to its members.

iii) Expressed gratitude that the Scheme had realized tremendous growth in its assets from Ug. Shs. 20.4 billion in 2009 to Ug. Shs. 152 billion in 2017. This growth ensures meaningful pension and benefits to the members. She encouraged to maintain the standard.

iv) She commended the Board of Trustees for the prudent investments and use of Scheme funds over the last three years.

v) She noted that the Scheme was making a monthly pension payment of over Ug. Shs. 131 million.

vi) She pledged her support to the Scheme on matters that will push it to greater heights.

vii) She urged members to provide all information required to the Scheme to enable smooth payment of beneficiaries.

viii) Requested the Board to have the issue of 5% limitation on loans discussed and resolved on the floor of Parliament to enable members benefit from the loans scheme.

ix) She thanked the Board for the dedicated services rendered to members.

5.0 PRESENTATION BY THE ACTUARY – M/S ARGEN ACTUARIAL SOLUTIONS

The Actuarial Report was presented and considered.

Purpose of the Actuarial Valuation were;

• Undertake an actuarial valuation of the Scheme Assets as at 30th June 2017 in compliance with the PPS Act and URBRA Act.

• To investigate whether the Scheme was financially sound at the valuation date.

Tommie W. Doubell, ARGEN Actuarial Solutions

• To review the guaranteed interest rate and actuarial factors for suitability and sustainability.

• Review the annual pension increases to cater for inflationary and economic pressures that impact on pensioners’ income.

i) All The following developments occurred during the period of review;

• Unisex annuity conversion factors were implemented with effect from 1st July, 2015.

• The PPS Act was amended as follows;

- Minimum qualifying service to receive a pension increased from 5 to 10 years.

- Allowable commutation portion increased from 25% to 33.3%.

- Disability benefit was removed.

- Minimum service for ill health retirement also increased to 10 years.

ii) All the necessary information was provided by the Fund Administrator as indicated below;

- Financial Statements.

- Member and Pension data.

- Investment information.

- PPS Act.

iii) The total membership of the Scheme was 807 members.

Table 1 : Summary of Active Membership

|

|

Number of Members |

Weighted average age |

Total annual payroll USh’m |

Member credit USh’m |

|

Staff: Male Staff: Female |

215 143 |

45.6 42.9 |

11,637 8,063 |

28,441 16,995 |

|

Total Staff |

358 |

44.6 |

19,700 |

45,435 |

|

MPs: Male MPs: Female |

296 153 |

51.1 47.8 |

39,443 20,392 |

52,101 26,040 |

|

Total MPs |

449 |

50.0 |

59,835 |

78,141 |

|

GRAND TOTAL |

807 |

48.0 |

79,535 |

123,576 |

iv) The Scheme had 103 Pensioners.

Table 2: Summary of Pensioners

|

Gender |

Number of Pensioners |

Weighted average age |

Total annual Pensions USh’m |

|

Male |

74 |

60.9 |

1,171 |

|

Female |

29 |

58.8 |

386 |

|

Total |

103 |

60.4 |

1,557 |

v) The Scheme’s investment returns were sustainable given historic returns and current interest rates on Treasury Bills and government bonds (approximately 80% of Scheme’s Assets as illustrated in the table below.

Table 3: Investment Returns

|

Financial Year Ending |

Net Annualized Return |

Inflation |

Real Return |

Fund Interest Declared |

|

30 June 2015 |

13.9% |

4.9% |

8.6% |

11.0% |

|

30 June 2016 |

14.6% |

5.9% |

8.2% |

8.0% |

|

30 June 2017 |

18.3% |

6.4% |

11.2% |

8.0% |

|

Average |

15.6% |

5.7% |

9.3% |

9.0% |

vi) The real value of pension received eroded to about 70% by inflation.

Table 4: Pension Increases

|

Financial Year Ending |

Pension increase awarded |

Inflation |

Increase as % of inflation |

|

30 June 2015 |

4.0% |

4.9% |

82% |

|

30 June 2016 |

4.0% |

5.9% |

68% |

|

30 June 2017 |

4.0% |

6.4% |

63% |

|

Average |

4.0% |

5.7% |

70% |

vii) The investments were as below;

Table 5: Investments

|

Investment Class |

30 June 2017 Market value USh’m |

% |

30 June 2014 Market value USh’m |

% |

|

Government Bonds |

83,026 |

54.6% |

24,957 |

38.6% |

|

Equity |

28,966 |

19.0% |

15,764 |

24.4% |

|

Fixed deposits |

27,888 |

18.3% |

8,869 |

13.7% |

|

Treasury bills |

11,652 |

7.7% |

12,864 |

19.9% |

|

Corporate Bonds |

666 |

0.4% |

2,259 |

3.5% |

|

Total |

152,199 |

100.0% |

64,713 |

100.0% |

viii) The Actuarial value of assets was illustrated below.

Table 6: Actuarial Value of Assets

|

|

USh’m |

USh’m |

|

Market value of investments |

|

152,199 |

|

Non-current assets |

|

231 |

|

Property and equipment |

231 |

|

|

Current Assets |

|

2,868 |

|

Accounts receivable |

1,781 |

|

|

Cash at bank |

1,087 |

|

|

Current Liabilities |

|

(2,471) |

|

Benefits payable |

(688) |

|

|

Accounts payable |

(1,541) |

|

|

Pensions payable |

(176) |

|

|

General reserve account |

(68) |

|

|

Net assets according to the financial statements |

|

152,827 |

|

Adjustments |

|

(625) |

|

General reserve account* |

68 |

|

|

Administrative reserves** |

(693) |

|

|

Actuarial value of assets |

|

152,201 |

*The creditor held in respect of the General reserve account is removed from the net asset used in the valuation and shown under the liabilities in Section 7.

**The administrative reserve held in the Scheme is not to be considered as part of the assets due to members of the Scheme.

ix) The revenue account was illustrated as below.

Table 7: Revenue Account

|

|

USh’m |

USh’m |

|

Fund value as at 30 June 2014 |

|

66,384 |

|

Income |

|

137,877 |

|

Member contributions |

31,038 |

|

|

Government contributions |

62,077 |

2,868 |

|

Investment income |

44,630 |

|

|

Release from General Reserve Account |

132 |

|

|

Outgo |

|

|

|

Fund expenses |

(1,928) |

|

|

Benefits awarded |

(38,711) |

|

|

Pensions paid |

(3,097) |

|

|

Income TAX |

(8,324) |

|

|

Fund value as at 30 June 2017 |

|

152,201 |

x) The Actuary reported that a Notional Pensioner Account was set up to represent the portion of the Scheme’s Assets related to Pensioners as follows.

Table 8: Notional Pensioner Account

|

|

USh’m |

|

Opening balance as at 30 June 2014 |

7,063 |

|

Transfers from the active member account |

14,485 |

|

Pensions paid per financial statements |

(3,097) |

|

Trivial pensions commuted |

(1,422) |

|

Expenses |

(289) |

|

Investment return |

5,915 |

|

Closing balance as at 30 June 2017 |

22,655 |

xi) The Notional Account may be used to determine portion of surplus due to pensioners and active member.

xii) The valuation results were as follows, overall financial position was as indicated in table below;

Table 9: Valuation Results (Overall Financial Position)

|

|

30 June 2017USh’m |

30 June 2014USh’m |

|

Actuarial value of assets |

152,201 |

66,384 |

|

Actuarial liability |

(143,840) |

(65,834) |

|

Active members |

(123,576) |

(58,572) |

|

Pensioner liability |

(20,197) |

(7,063) |

|

General Reserve Account |

(68) |

(200) |

|

Actuarial surplus/(deficit) |

8,361 |

550 |

|

Funding level |

105.8% |

100.8% |

xiii) The valuation results for active members was indicated as below.

Table 10: Valuation Results (Active Members)

|

Active Members |

30 June 2017USh’m |

30 June 2014USh’m |

|

Assets in respect of active members |

129,479 |

59,122 |

|

Actuarial liability |

(123,576) |

(58,572) |

|

Actuarial surplus/(deficit) |

5,903 |

550 |

|

Funding level |

104.8% |

100.9% |

xiv) The Actuary recommended an additional bonus of 3% to active members as at the valuation date.

• The cost of the bonus would be 3.707 billion reducing the funding level for active members to 101.7%.

• The remaining surplus can act as a guard against the risk of investment returns falling below the guaranteed rate of 8%.

xv) The valuation results for pensioners were as illustrated in the table below.

Table 11: Valuation Results (Pensioners)

|

Notional Pensioner Account |

30 June 2017USh’m |

30 June 2014USh’m |

|

Actuarial value of account |

22,655 |

7,063 |

|

Actuarial liability |

(20,197) |

(7,063) |

|

Pensioners |

(18,798) |

(6,810) |

|

Deferred Pensioners |

(1,399) |

(253) |

|

Actuarial surplus/(deficit) |

2,458 |

|

|

Funding level |

112.2% |

100.0% |

• The Actuary recommended that pensions be increased in line with inflation during the valuation period:

- Pensioners that were present during the valuation period will therefore receive an increase of 5.2% (=1.049 x 1.064 – 1.043) whilst new pensioners will receive proportional increases based on inflation since the date of their retirement.

- The cost of increase will amount to Ug. Shs. 1.356 billion with the funding level in respect of pensioners reducing to 105.1%.

xvi) The valuation results after bonus and pension increase was illustrated as in the table below.

Table 12: Valuation Results (After bonus and pension increase)

|

|

Before USh’m |

After USh’m |

|

Actuarial value of assets |

152,201 |

152,201 |

|

Actuarial liability |

(148,840) |

(148,904) |

|

Active members |

(123,576) |

(127,283) |

|

Pensioner liability |

(20,197) |

(21,553) |

|

General reserve account |

(68) |

(68) |

|

Actuarial surplus/(deficit) |

8,361 |

3,297 |

|

Funding level |

105.8% |

102.2% |

xvii) The analysis of change in financial position was as indicated below;

Table 13: Active Members

|

|

USh’m |

|

Surplus as at 30 June 2014 |

550 |

|

Prior year adjustment – members credit |

42 |

|

Prior year adjustment – benefits |

(73) |

|

Under-allocation of Investment returns |

7,023 |

|

Fund expenses |

(1,639) |

|

Miscellaneous |

(1) |

|

Surplus as at 30 June 2017 |

5,903 |

Table 14: Pensioners

|

|

USh’m |

|

Surplus as at 30 June 2014 |

- |

|

Change in annuity factors |

(26) |

|

Investment surplus |

2,695 |

|

Fund expenses |

(289) |

|

Miscellaneous |

78 |

|

Surplus as at 30 June 2017 |

2,458 |

xviii) Sensitivity analysis was carried out based on economic assumption of investment returns.

Table 15: Sensitivity Analysis (Economic Assumptions of Investment Returns)

|

Notional pensioner account |

Current valuation USh’m |

Scenario 1A lower return USh’m |

Scenario 1B higher return USh’m |

|

Actuarial value of account |

22,655 |

22,655 |

22,655 |

|

Actuarial liability |

(20,197) |

(22,087) |

(18,573) |

|

Pensioners |

(18,798) |

(20,557) |

(17,288) |

|

Deferred Pensioners |

(1,399) |

(1,530) |

(1,285) |

|

Actuarial surplus/(deficit) |

2,458 |

567 |

4,081 |

|

Funding Level |

112.2% |

102.6% |

122.0% |

xix) Sensitivity analysis was carried out based on economic assumptions of mortality improvement.

• Considered the impact on pensioners of an increase and decrease in mortality improvement.

Table 16: Sensitivity Analyses (Economic Assumptions of Mortality Improvement)

|

Notional pensioner account |

Current valuation USh’m |

Scenario 2A Higher mortality improvement USh’m |

Scenario 2B Lower mortality improvement USh’m |

|

Actuarial value of account |

22,655 |

22,655 |

22,655 |

|

Actuarial liability |

(20,197) |

(21,263) |

(19,751) |

|

Pensioners |

(18,798) |

(19,777) |

(18,390) |

|

Deferred Pensioners |

(1,399) |

(1,486) |

(1,361) |

|

Actuarial surplus/(deficit) |

2,458 |

1,392 |

2,903 |

|

Funding Level |

112.2% |

106.5% |

114.7% |

The findings of the Actuary were as follows;

a) The Scheme was 105.8% funded at the valuation date. The Scheme was therefore financially sound as at the valuation date.

b) In order to determine the portion of surplus due to actives and pensioners, a notional pensioner account was set up which represents the portion of the Scheme’s assets related to pensioners. Based on this, the funding level for active members and pensioners at the valuation date was 104.8% and 112.1% respectively.

c) The proportions invested in the various asset classes changed slightly over the valuation period. The majority of assets however remain invested in Government Bonds. The assets of the Scheme were found to be an appropriate match for the liabilities of the Scheme.

d) The current unisex annuity conversion factors seem to remain appropriate, since the analysis of experience showed no significant gains or losses as a result of mortality experience. We however recommend that the appropriateness of the annuity factors be reviewed at each valuation.

e) It was noted that the vesting scale on withdrawal benefits had not been applied for Members of Parliament. This was contrary to the Act and the Board should consider how this should be addressed.

Bases on the findings, the Actuary recommended the following;

a) Based on the surplus available in respect of the active members, an interest of 11% (3%) above the guaranteed rate of (8%) be declared to active members for the three year ending 30th June 2017. The cost of this bonus would be UShs 2 638m, reducing the funding level for active members to 102.6%.

b) The remaining surplus (2.6% of active member liabilities) could act as a guard against the risk of investment returns falling below the guaranteed rate of 8%, without being at a level that creates unreasonable cross- subsidies over different generations.

c) Based on the surplus in respect of pensioners, pensions be increased in line with inflation during the valuation period. The Cost of this pension increase would amount to UShs 1 356m, with the funding level in respect of pensioners reducing to 105.1%.

d) Should the recommendations for a bonus declaration and pension increases be implemented, the Scheme would still be financially sound with an overall funding level of 102.9%.

e) Performing a high-level review of the financial position of the Scheme on an annual basis and declare a bonus rate and pension increases based on the investment returns earned during the year and the surplus available.

6.0 PRESENTATION BY INVESTMENT MANAGER, M/S AFRICAN ALLIANCE AND GEN AFRICA ASSET MANAGERS

The Investment Report was presented and considered.

A) M/s African Alliance

i) The recovery in economic activity continued in Quarter 4 of 2016/17 as real GDP expanded by 2.5% (1.3% in quarter 1 of 2017/18)

ii) Annual Real GDP growth for 2017/18 forecasted in the range of 5.0 – 5.5%.

iii) Headline inflation of 3.3% and core inflation of 3.0% continued its downward trend in Quarter 4 of 2017.

iv) The Bank of Uganda adopted an expansionary monetary policy stance throughout 2017 and kept the Central Bank Rate (9.5%) unchanged in December 2017.

v) The Central Bank Rate (CBR) was reduced by 50 (to 9.5%) basis points in Quarter 4 of 2017 (reduced by 200 bps) to 10% in Quarter 3 of 2017. The monetary policy remained accommodative in the year 2017.

vi) The Uganda Shilling depreciated slightly more in Quarter 4 than in Quarter 3 (relative to the USD and KES).

vii) The Uganda Shilling shed 0.98% and 1.11% relative to the US dollar and Kenyan Shilling respectively in Quarter 4 of 2017.

viii) For domestic equities, Uganda All Share Index (UGSINDX) was (+16.45%) in the 4th Quarter of 2017 (+35.44%) YTD (December 2017).

ix) Regional equities were as follows;

• NSEASI – (+6.58%) in Quarter 4, (+28.56%) YTD (Quarter 4 high of 6180 points).

• UGSINDX – (+16.45%) in Quarter 4 of 2017 (+35.44%) YTD (Quarter 4 high 200 points).

x) The portfolio performance as at June 2017 is illustrated in the table below:

Table 1: Portfolio Performance as at June 2017

|

Performance |

1 Month |

3 Months |

1 Year |

3 Years Annualized |

|

Total |

1.90% |

5.80% |

13.34% |

12.19% |

|

Benchmark |

0.91% |

2.76% |

11.50% |

11.50% |

|

Relative Return |

0.99% |

3.04% |

1.84% |

0.69% |

i) Asset class performance of Domestic bonds was illustrated in the table below.

Table 3: Asset Class Performance – Domestic Bonds

|

Performance |

1 Month |

3 Months |

1 Year |

3 Years Annualized |

|

Bonds |

1.79% |

5.46% |

19.61% |

16.53% |

|

Benchmark |

1.12% |

3.51% |

16.10% |

16.51% |

|

Relative Return |

0.67% |

1.95% |

3.51% |

0.03% |

ii) Asset Class performance of Domestic Money Market was illustrated in the table below.

Table 4: Asset Class Performance – Domestic Money Market

|

Performance |

1 Month |

3 Months |

1 Year |

3 Years Annualized |

|

Money Market |

1.02% |

3.22% |

15.54% |

14.33% |

|

Benchmark |

0.98% |

2.98% |

14.45% |

15.00% |

|

Relative Return |

0.05% |

0.24% |

0.09% |

-0.68% |

Asset Class performance of Domestic Equity was illustrated in the table below.

Table 5: Asset Class Performance – Domestic Equity

|

Performance |

1 Month |

3 Months |

1 Year |

3 Years Annualized |

|

Equity |

1.67% |

0.73% |

-5.05% |

2.81% |

|

Benchmark |

1.01% |

-0.84% |

-2.32% |

13.18% |

|

Relative Return |

0.66% |

1.57% |

-2.73% |

-10.37% |

iv) Asset Class performance of Regional Equity was illustrated in the table below.

Table 6: Asset Class Performance – Regional Equity

|

Performance |

1 Month |

3 Months |

1 Year |

3 Years Annualized |

|

Regional |

5.24% |

29.33% |

16.61% |

6.62% |

|

Benchmark |

3.22% |

17.68% |

12.26% |

5.66% |

|

Relative Return |

2.02% |

1.65% |

4.35% |

0.97% |

B) M/s Gen Africa Asset Managers

i) Kenya’s economic growth averaged 5.2% of the financial year 2016/17 driven by manufacturing and tourism, whereas agriculture contracted.

ii) Kenya Shilling depreciated by 2.5% during the financial year 2016/17 against the dollar attributes to monetary policy tightening in the US.

iii) Inflation rose in financial year 2016/17 averaging 8.1% compared to 6.4% in the previous financial year.

iv) Return since inception thus December 2016 to June 2017 is illustrated below.

|

Asset Class |

Return per Asset Class |

|

Equities |

16.60% |

|

Government Bonds |

12.39% |

|

Corporate Bonds |

6.69% |

|

Money Market |

11.81% |

|

Overall Return |

15.22% |

v) The equities asset class had the highest return.

vi) M/s Gen Africa Asset Managers 40% of the Fund.

vii) The Board set a strategic target of 11.5% after tax return on invested funds.

M/s KCB Presentation by the Custodian

It was noted that;

i) The main function of the Custodian was to hold assets of a retirement benefits Scheme and to deal with all administrative matters relating to those assets.

ii) The appointment of a Custodian provides checks and balances among the service providers and also ensures compliance with the regulators.

iii) The summary of the Scheme investments were as follows.

iv) Investments Summary as at June 2017

|

|

Gen Africa |

African Alliance |

|

|

Asset Class |

Value (UGX) |

Value (UGX) |

Totals (UGX) |

|

Cash |

130,956,668 |

33,476,661 |

164,433,329 |

|

Corporate Bonds |

292,482,760 |

398,840,127 |

691,322,887 |

|

Equities (USE) |

4,347,433,349 |

6,117,512,522 |

10,464,945,871 |

|

Equities (NSE) |

7,790,466,447 |

10,575,744,704 |

18,366,211,151 |

|

Treasury Bills |

3,692,689,873 |

8,100,715,722 |

11,793,405,595 |

|

Bonds |

42,478,014,225 |

34,512,009,590 |

76,990,023,815 |

|

Fixed Deposits |

1,117,589,397 |

26,901,258,621 |

28,018,848,018 |

|

|

59,849,632,719 |

86,639,557,947 |

146,489,190,666 |

7.0 PRESENTATION OF THE BOARD OF TRUSTEES REPORT

The report of the Board of Trustees for the year ending 30th June 2017 was presented, considered and adopted.

The following were the highlights of the report.

i) The Scheme had a Board of Trustees and four Board Committees namely; Finance and Administration Committee, Investment and Custody Committee, Audit and Risk Committee and Benefits Administration Committee.

ii) During the reporting period the Board of Trustees held 13 meetings, Finance and Administration Committee 5 meetings, Investment and Custody Committee 3 meetings, Audit and Risk Committee 7 meetings and Benefits Administration Committee 2 meetings.

iii) As at 30th June 2017, the Scheme had 795 active members (292 women and 503 men), 102 pensioners, 3 deferred members and 4 beneficiaries.

iv) The financial highlights were as below;

• The Scheme grew from 104.14 billion to Shs. 152.83 billion posting a 46.8% rate of growth. The significant growth is attributed to reduced payouts made during the year.

• The growth in members’ contribution was 11.6% during the year compared to 21.6% the previous year.

• The return on investable fund before tax for the year was 15.7% (13.8% after tax) compared to 12.47% (10.08% after tax) the previous year.

• The investment income before tax increased by 58.4% from Shs. 12.54 billion to Shs. 19.85 billion due to sound investment policies and favorable market conditions.

• The Board of Trustees approved crediting members’ accounts with interest rate of 8% per annum.

• The Board continued to apply the unisex conversion factors for retiring members.

v) During the financial year the Board used M/s KCB (U) Ltd to keep custody of all Scheme Assets.

vi) The Actuarial Valuation was done as at 30th June 2017 and the Scheme was found to be financially sound. The funding level was Ug. Shs. 152.2 billion which was 105.8% of total liabilities. The Scheme posted a surplus of UgX. 8.36 billion (5.8%).

8.0 PRESENTATION OF FINANCIAL STATEMENTS FOR THE PERIOD ENDED 30TH JUNE 2017

The Financial Statements were presented, considered and adopted.

A) Statement of Changes in the Net Assets for the year ended June 30th, 2017.

|

|

30th June 2017 UGX |

30th June 2016 UGX |

|

Investments |

110,435,352,370 |

81,333,550,123 |

|

Property, Plant & Equipment |

231,305,351 |

185,584,942 |

|

Total Current Assets |

44,631,410,456 |

25,802,355,653 |

|

Total Current Liabilities |

2,471,385,174 |

3,181,328,360 |

|

Net Total Assets |

152,826,683,003 |

104,140,162,358 |

The above assets were financed by;

|

|

30th June 2017 UGX |

30th June 2016 UGX |

|

Members Accumulated Fund |

152,131,344,122 |

104,006,971,900 |

|

Administrative Reserves |

693,039,434 |

128,355,447 |

|

Deferred Income |

2,299,447 |

4,835,011 |

|

Total Net Assets |

152,826,638,003 |

104,140,162,358 |

B) Statement of the Cash Flow for the year ended 30th June, 2017

|

|

30th June 2017 UGX |

30th June 2016 UGX |

|

Net cash from operating activities |

34,660,166,775 |

(7,675,261,110) |

|

Net cash used in investing activities |

(40,769,362,711) |

13,529,666,793 |

|

Cash balance at start of year |

7,196,272,703 |

1,341,867,020 |

|

Cash balance |

1,087,076,767 |

7,196,272,703 |

9.0 PRESENTATION OF THE REPORT OF THE AUDITOR GENERAL

A report of the Audited Accounts of the Parliamentary Pension Scheme was presented by a representative of the Auditor General.

In the opinion of the Auditor General, the financial statement presented fairly in all material represents the financial position of the Parliamentary Pension Scheme as at 30th June 2017 and of its financial performance for the year ended in accordance with international financial reporting standards, the Parliamentary Pensions Act 2017 as amended and the Uganda Retirement Benefits Regulatory Authority Act 2011.

10.0 CONFIRMATION OF PREVIOUS MINUTES

Confirmation of Previous Minutes of the 5th Annual General Meeting

The minutes of the 5th Annual General Meeting were read, corrected and confirmed as a true record of what transpired during that meeting.

11.0 OBSERVATIONS /REACTIONS FROM MEMBERS

The following were the matters arising from the previous minutes and reactions from the presentations above.

a) Members noted that the issue of unclaimed benefits was still persistent. Management clarified that the Board had taken over the challenge to ensure the issue is dealt with. However the challenge of dispensation of benefits also arose from the failure of members to update their files or information with the Scheme.

b) Low pension earnings for members who joined before 2011 was an issue of concern. The Chairperson explained that pensioners who retired before 2011 earn low pension because at that time the basic salary was very low. The Board had no mandate to use revenue of existing members to enhance pension. However guidance on the modalities of enhancement was included in the terms of reference for Actuarial Valuation of assets as at 30th June, 2017.The draft report was received and would be submitted to the Rt. Hon. Speaker for guidance. The Actuary advised that the sponsor commits funds for the enhancement. Retired staff also requested to be considered given that they were equally affected. It was also noted that the members were retiring at different levels of income and status and that would determine their pension.

The Members of Parliament who served between 1962 and 2001 would be given a one off payment.

c) There was discontent on the discrimination against pensioners in accessing loans. The Board was requested to consider access to loans by Pensioners. It was reported that currently the Parliamentary Pensions Act and URBRA Act prohibits lending to pensioners. However, the Board had been engaging Commercial Banks on how best they can help pensioners acquire loans.

d) Members inquired why the choice of Service providers such as Custodians and Investment Managers were foreign companies with no participation of local banks in Uganda. It was clarified that there are minimum requirements to qualify for bidding such as licensed by the Capital Markets Authority, Bank of Uganda and the Uganda Retirement Regulatory Authority. Most of the local banks never participated in the bidding process, despite the open call placed in the print media. Those that participated failed to satisfy the preliminary requirements.

e) The Board was tasked to push for an amendment to enhance the lending portfolio within the legal framework to enhance return on investment. The Chairperson informed members that an amendment to get a cup of more than 20% for loans would be tabled to the flow of Parliament.

f) The Board and Management were tasked to actively engage members to attend Annual General Meetings and other events organized by the Scheme.

g) Provision of health insurance for pensioners was a key requirement that had not yet been addressed. The age limit of access to medical insurance of 63 years for male and 64 years for females was a challenge. The Chairperson clarified that the Board was trying to study its fiduciary duty and modalities upon which such a service can be implemented. One of the options could be to deduct some money from the profit of pensioners’ investments and get members a medical insurance.

h) Members appreciated timely payment of pension.

i) Most members of the Scheme were not well informed and efficiently mobilized to attend Scheme events. The Board was urged to ensure timely sensitization and dissemination of information in this regard.

j) The Board made an undertaking to ensure that the Annual General Meeting is always held by February 28th as stipulated in the law.

k) It was explained that the delay arose due to the long procurement process for provision of Actuarial Services of which the Actuarial Valuation Report had to be discussed during the Annual General Meeting.

l) It was reported that the Board of Trustees approved refund of transport allowance based on distance travelled by pensioners.

m) The Management costs currently are at 1.9% of the total assets. 56% of the budget is supported by the Commission.

n) The Parliamentary Pension Scheme obtained a court order to recover Ug. Sh. 39,447,007 from M/s NALECO which was transferred to its account in error. The Legal and Legislative Depart to follow up the recovery process.

o) Members requested to be availed with copies of the presentation of the Chief Operations Manager. It was observed that many members were not informed about the meeting.

p) It was decided that Notice for Annual General Meeting together with the working documents should be sent to members at least one week before the date of the meeting.

q) Amendment to the Act to exempt Pension administration from the Succession Act was being prepared.

r) Members thanked the Board for a commendable job done by giving them 11% interest on their Scheme credit for the financial year 2016/17. However, members noted that it was little and out of the Board’s choice.

s) It was observed that in future pensioners will be more than the active members so there was need to reconsider the composition of the Board by increasing the number of pensioner’s representatives.

t) Members were urged in the next Annual General Meeting to endeavor to keep time.

u) The meeting further observed that members who had served less than five years and below 45 years of age and opted for a lump sum payment were living a miserable life. The Board was urged to consider advising such a category to always defer their pensions until they qualify for pension.

12.0 THE CHAIRPERSON’S CLOSING REMARKS

In his closing remarks, the Chairperson thanked members’ for attending and actively participating in the session. He commended the service providers for all their contributions and continued support. The Chairperson finally thanked the staff of the Scheme and the Trustees for the hard work exhibited in organizing the event.

The meeting was adjourned at 1:50 pm.